How System Work

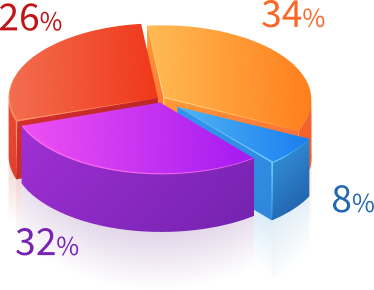

Real-time Monitoring and Analysis: As transactions occur, the system applies advanced algorithms and analytics techniques to analyze the data in kafka streams. It compares each transaction against established patterns, rules, and thresholds to identify suspicious activities or anomalies that deviate from normal behavior.

Fraud Detection and Alerts: When a suspicious transaction or activity is detected, the system generates an alert or flag for further investigation. This prompt notification enables fraud analysts to take immediate action and mitigate potential risks.