Businesses are moving more and more away from open, shared AI technologies in this age of swift AI adoption. Also, toward private AI Roadmaps, which are organised plans that guarantee the safe, legal, and effective application of AI. Developing a careful AI roadmap is essential for striking a balance between innovation and governance, particularly for …

Enterprise use of private LLMs and domain-trained models is growing at an unprecedented rate. AI is already used in at least one business function by 78% of organisations, according to recent industry research. Large language models (LLMs) fuel many of these deployments, which drive workflows across security, analytics, automation, and customer engagement. However, enterprise LLM …

The private AI for enterprises has reached a tipping point where organisations must choose between developing unique solutions or adopting pre-built platforms. Companies across industries are under increasing pressure to incorporate AI assistants. This may alter how employees access information, automate procedures, and make choices, and yet the route forward remains unclear for many leadership …

Private LLM in VPC deployments is becoming a key component of secure, enterprise-grade AI infrastructure as businesses quicken their adoption of AI. Large language models (LLMs) are currently widely used; more than 67% of businesses aim to implement generative AI, indicating a quick transition from testing to production. But this expansion raises serious issues with …

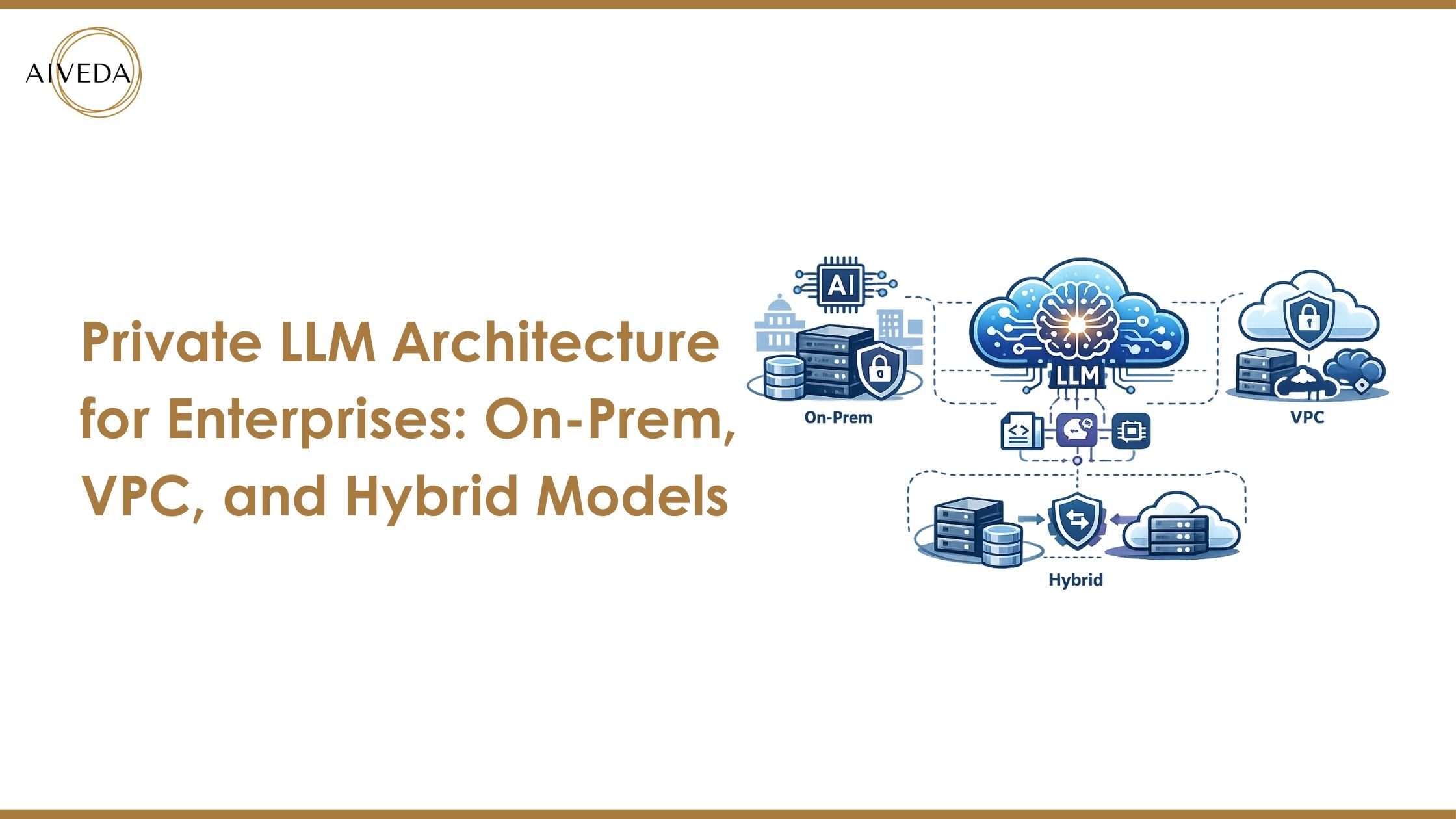

Businesses across all sectors are quickly transitioning from generative AI exploration to full-scale production use. On-prem LLM deployment has become a strategic objective for companies that require more control, security, and predictability from their AI systems as this change quickens. Even though public and cloud-hosted LLM environments are quick and easy, businesses that handle sensitive …

Enterprises no longer experiment with generic AI tools. They now demand precision, control, and measurable outcomes. This shift explains the growing focus on private LLM use cases built for specific business functions. Instead of deploying a single horizontal model across the organization, companies design private LLMs for enterprises that align with legal, support, compliance, and …

Enterprises are rapidly moving beyond public AI technologies as data privacy, compliance, and intellectual property threats mount. Enterprise private LLM systems, which offer organisations more control over the deployment, governance, and scaling of AI models, have become more popular as a result of this change. However, creating the ideal private LLM architecture is just as …

The debate between private LLM vs public LLM has swiftly progressed from a technical discussion to a decision at the boardroom level. The choice of deployment strategy has a direct impact on security posture, cost predictability, regulatory readiness, and long-term AI ownership as businesses integrate massive language models into mission-critical workflows, such as customer support, …

US-based companies are reconsidering how they use massive language models as AI becomes increasingly integrated into business processes. Choosing a private LLM provider that can securely power mission-critical systems is now more important to high-intent enterprise purchasers than experimenting with AI capabilities. The wrong provider selection can result in serious operational and legal risk, ranging …

Artificial intelligence is now a fundamental corporate capacity rather than an experimental technology. AI is increasingly ingrained in the operations of contemporary businesses, powering customer-facing apps and automating internal tasks. As adoption grows, companies are increasingly faced with a strategic decision: should they rely on SaaS AI tools or invest in a private large language …